- The Idea Farm

- Posts

- Divergence, Downside & The Dollar

Divergence, Downside & The Dollar

+ PIMCO, Goldman Sachs, Carlyle, Citadel, AllianceBernstein & More

Sponsored by

“One of the speculators' hells consists of thinking of the money you didn't make. If you had only done what you ought to have done, but didn't!”

Research

PIMCO - Compounding Opportunity (11 pages)

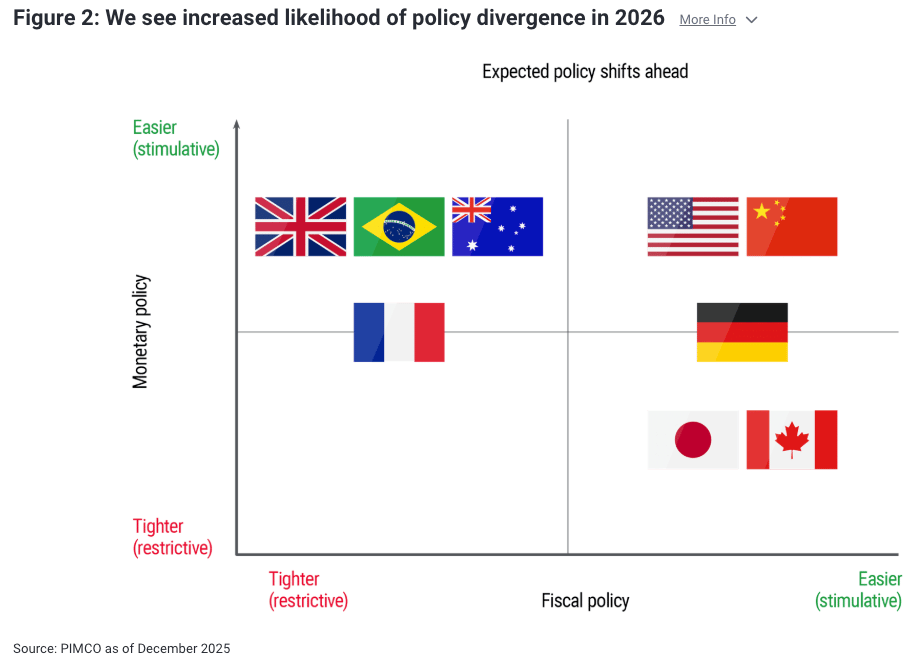

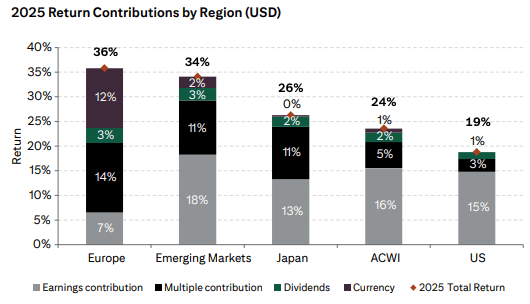

PIMCO’s Cyclical Outlook contends that high quality fixed income still offers attractive yield and diversification as equities look expensive and credit spreads look tight. It expects AI investment and fiscal policy to keep growth resilient while creating a more K shaped economy where outcomes depend on exposure to technology and pricing power.

Carlyle - Five Questions for 2026 (20 pages)

Carlyle’s Jason Thomas looks at five questions that he believes will be central to market activity in 2026:

How will the “affordability crisis” impact Fed policy?

Have critics focused on the wrong credit boom?

Are data centers “crowding out” investment in other sectors?

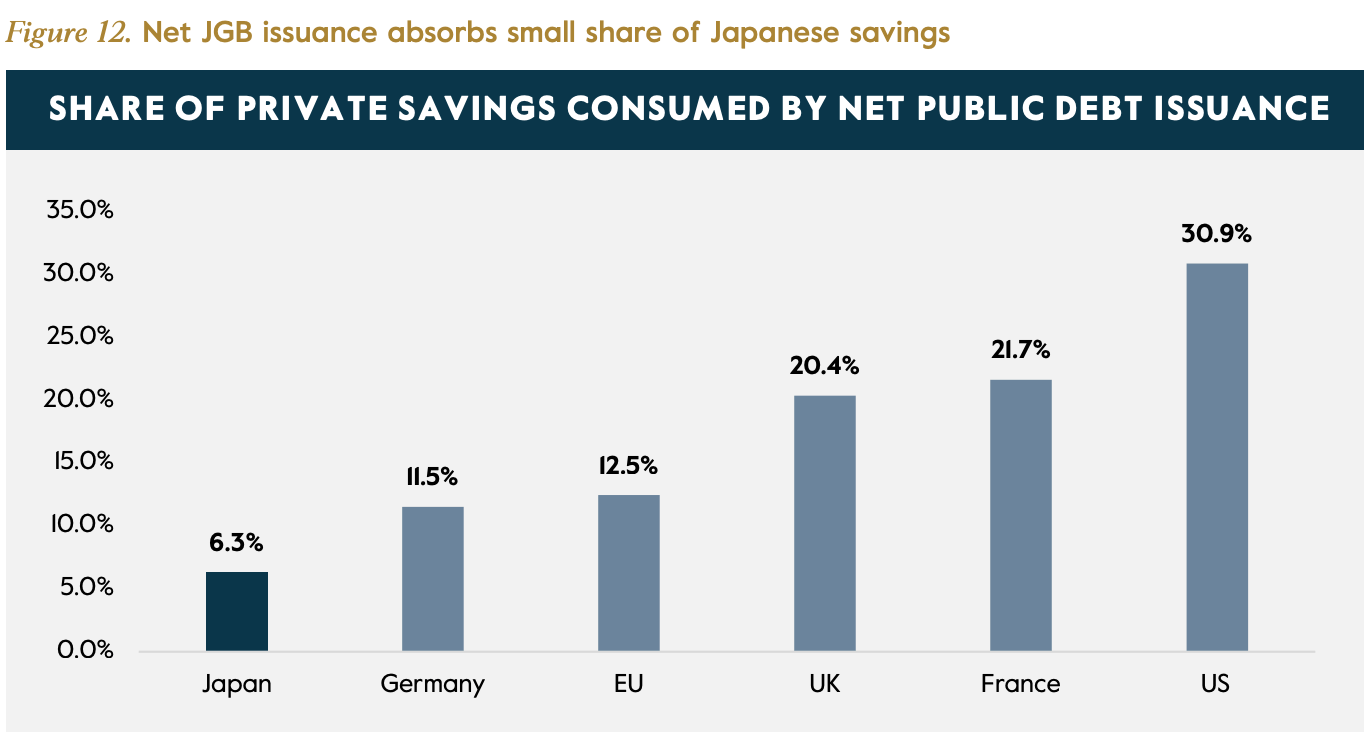

What message are bond and FX markets sending about Japan?

Does the European Union need a new treaty?

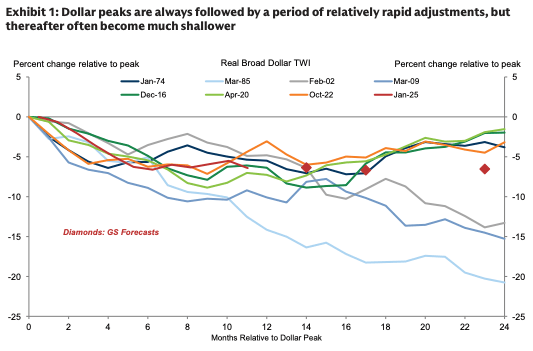

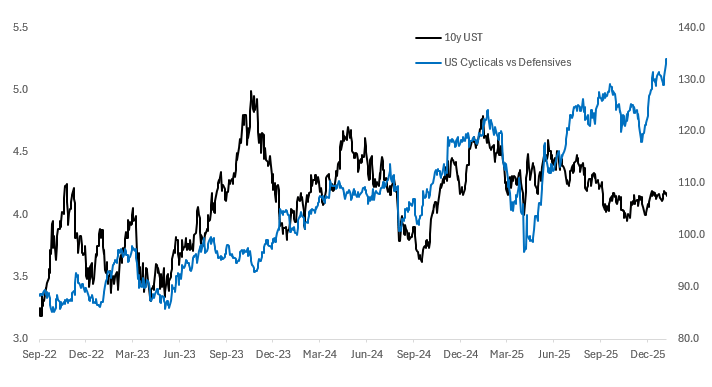

Goldman Sachs expects a shallow dollar decline in 2026 as global growth broadens and relative returns become more balanced, shifting leadership toward pro cyclical currencies. It notes upside dollar risks if US growth stays resilient enough to sustain high valuation and keep foreign demand for US assets firm.

Citi’s Kate Moore lays out her 2026 first quarter positioning with a balanced risk on stance, underweight duration, and strategic gold exposure as a diversifier. She emphasizes staying disciplined amid noisy narratives while keeping technology and AI exposure central to the earnings and cash flow outlook.

Citadel - Life in the Fast Lane (10 pages)

Citadel’s Frank Flight believes markets are underpricing US growth, particularly relative to Europe. This is most apparent in the valuation of 10 year rates (both outright and cross market). Flight finds that European growth pricing sits at the 71st percentile relative to US growth pricing which sits at just the 55th percentile (10 year history).

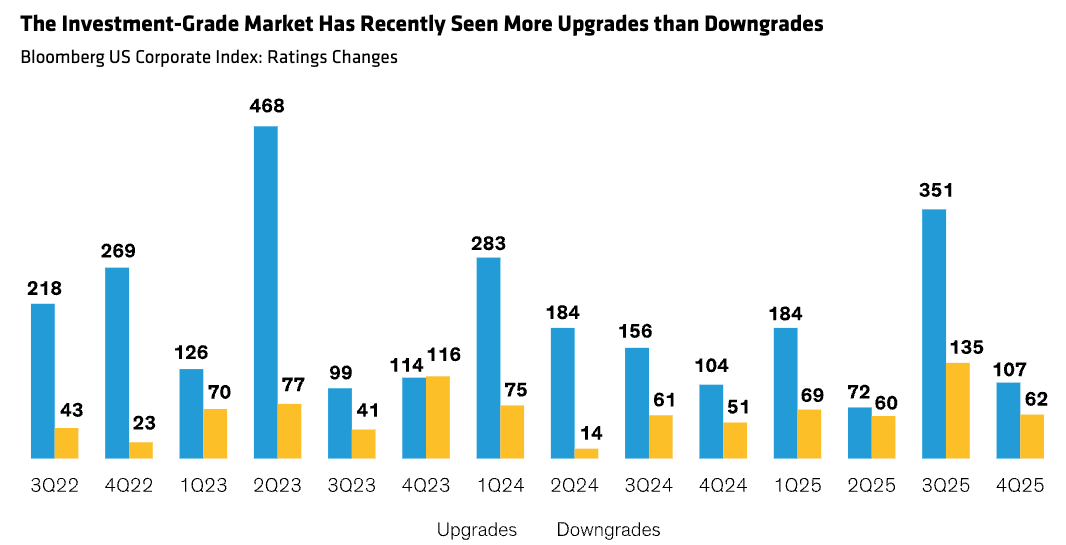

AllianceBernstein expects credit to face wider dispersion as AI infrastructure spending reshapes issuers and capital structures. They highlights resilient fundamentals and elevated yields, but notes tight spreads make security selection and intermediate maturity positioning more important.

J.P. Morgan Asset Management sees public-private convergence accelerating, with private markets near $20 trillion. They suggest alternatives can broaden access to innovation, add diversification, and reward selectivity on liquidity and underwriting.

Can You Simplify a Tax-Locked Portfolio Without Selling?

Section 351 exchanges can be a powerful tool for simplifying complex, tax-locked portfolios, but successful execution depends on experience and preparation.

Alpha Architect has supported multiple 351 exchange launches and worked with advisors through the full process, from education and eligibility review to onboarding and execution. These real-world experiences shape how we approach advisor education and client guidance today.

On February 3, we’re hosting a LIVE educational webinar that shares practical insights from prior 351 exchanges, common portfolio use cases, and key considerations advisors should understand before moving forward. We’ll also highlight our 351 Education Center, featuring short videos, visuals, and educational resources designed to support informed decision-making.

Join us to learn from experience and see whether a 351 exchange may fit your clients’ needs.

Podcasts

Sir Niall Ferguson explains how financial history sharpens investing decisions, helps navigate risk, and improves making big market calls. |

Grant Williams explains the “hundred year pivot”, how declining trust reshaping money and markets, and portfolio implications across currencies, commodities, and higher volatility. |

Matthew Dicks explains storytelling mastery, building compelling narratives, and presenting them effectively. |

What Else Is Happening

Bernstein argues that the market is defined by rampant speculation and extreme narrowness, crypto is the first global investment bubble, corporate credit is priced for perfection, and more. |

Did you miss last week’s email?