- The Idea Farm

- Posts

- Housing Headwinds

Housing Headwinds

+ Hendrik Bessembinder, Rajiv Jain, Owen Lamont, Carlyle & More

Sponsored by

“October. This is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August, and February.”

Research

Morningstar - Financial Services Observer (86 pages)

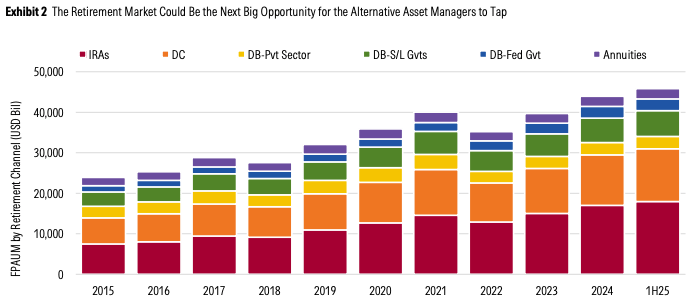

Morningstar provides an analysis of alternative investment market trends, investor allocations, and evolution of the landscape

Hendrik Bessembinder examines how constant leverage strategies behave over time, with a focus on levered single stock ETFs. He shows that daily rebalancing and financing frictions erode returns, particularly when volatility is high and prices frequently reverse.

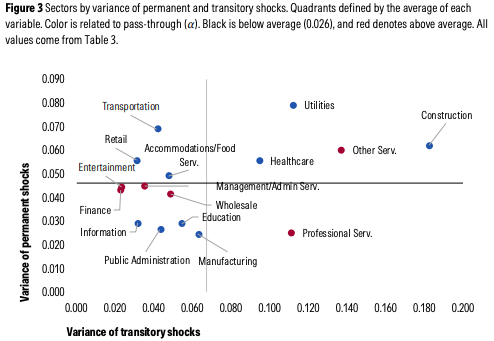

Morningstar explores how income shocks like layoffs, industry shifts and technology change can undermine traditional lifecycle plans. It shows that modeling these shocks can lead to higher recommended savings and more conservative equity allocations tailored to a client’s career path and industry risk.

Paul Schmelzing studies long run global housing performance and argues that high housing valuations today reflect a continuation of multi century trends shaped mainly by falling discount rates rather than a recent bubble.

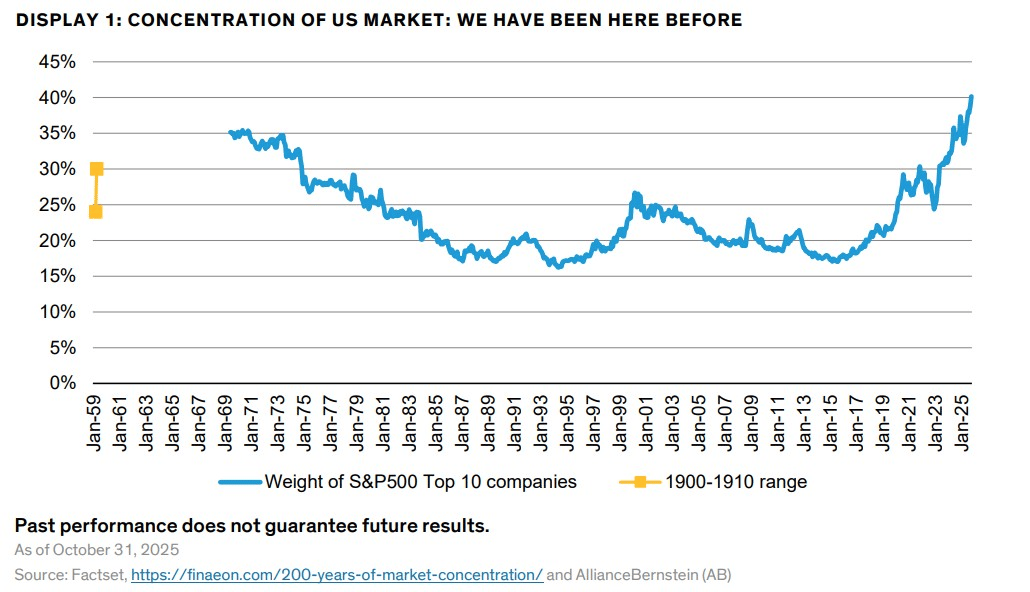

Inigo Fraser-Jenkins, the Co-Head of Institutional Solutions at AllianceBernstein, covers what he sees as the dystopian symbiosis of platform capitalism and passive investing.

Goldman Sachs examines US housing affordability, with price to income and mortgage payment ratios at multi decade highs and rents at the highest since 1980. They estimate a 3 to 4 million home shortfall and find easing land use rules could add about 2.5 million units over a decade, closing two thirds of the gap.

Bonus Content

Deutsche Bank’s chart book looks at whether or not there’s an AI bubble. Link

Pitchbook published 2026 outlooks for both US Private Equity and Venture Capital.

Schroders explains how the classic 60/40 portfolio became the most concentrated balanced portfolio in modern history, and how to bring genuine diversification back to life. Link

Morgan Housel explains why independence is the key to producing great work. Link

Carlyle’s Jason Thomas touches on the increase in the capital intensity of formerly “asset-light” businesses. Link

AAEQ is officially live. Next up is AAUA

AAEQ is officially live. The Alpha Architect U.S. Equity 2 ETF launched on December 10 with $479 million in initial assets, providing advisors a streamlined destination for consolidating appreciated stocks and ETFs through a syndicated 351 exchange.

Next up is AAUA, the U.S. Equity 3 ETF scheduled to launch on March 26, 2026, built on the same structural blueprint and 0.15% expense ratio.

Learn more and review the AAUA launch timeline at funds.alphaarchitect.com/aaua.

Investors should carefully consider the investment objectives, risk, charges, and expenses of the funds. This and other important information is in the indicated fund's prospectus, which may be obtained by calling (215) 882-9983 or by visiting https://funds.alphaarchitect.com/documents/. The prospectus should be read carefully before investing. The Fund is distributed by PINE Distributors LLC.

*See disclaimer

Podcasts

Rajiv Jain explains why AI hype resembles past bubbles, outlines concentration risk, and highlights selective opportunities in quality emerging market leaders. |

Man Group’s Robyn Grew discusses scaling a public hedge fund, leveraging technology, and building a talent first culture. |

Adam Mastroianni explores cultural stagnation, why institutions stifle novelty, and how incentives reshape creativity. |

What Else Is Happening

David McWilliams explores the story of money, incentives and institutions, and lessons from historical boom-bust cycles. |

Did you miss last week’s email?

*This information does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. Certain information contained herein has been obtained from third party sources and such information has not been independently verified by The Idea Farm. No representation, warranty, or undertaking, expressed or implied, is given to the accuracy or completeness of such information by The Idea Farm or any other person. While such sources are believed to be reliable, The Idea Farm does not assume any responsibility for the accuracy or completeness of such information. The Idea Farm does not undertake any obligation to update the information contained herein as of any future date.