- The Idea Farm

- Posts

- Outlook Season

Outlook Season

+ Goldman Sachs' 2026 Outlook, Cliff Asness, Sir Chris Hohn, Aswath Damodaran & More

Sponsored by

“Americans are getting stronger. Twenty years ago, it took two people to carry ten dollars' worth of groceries. Today, a five-year-old can do it.”

Research

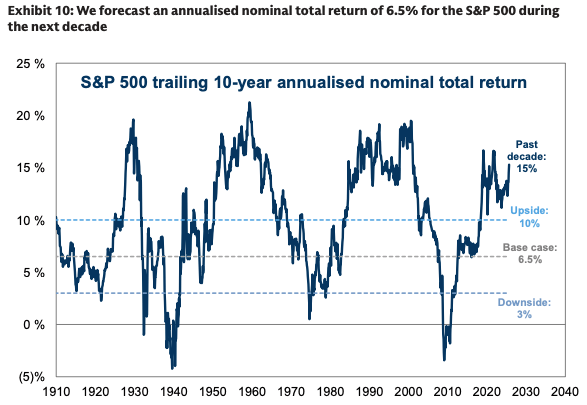

Peter Oppenheimer projects global equities can deliver about 7.7% annual returns over the next decade, driven mainly by earnings growth and dividends. He also highlights richer long run opportunities in emerging markets and Asia, especially if the dollar weakens and AI benefits prove broad based.

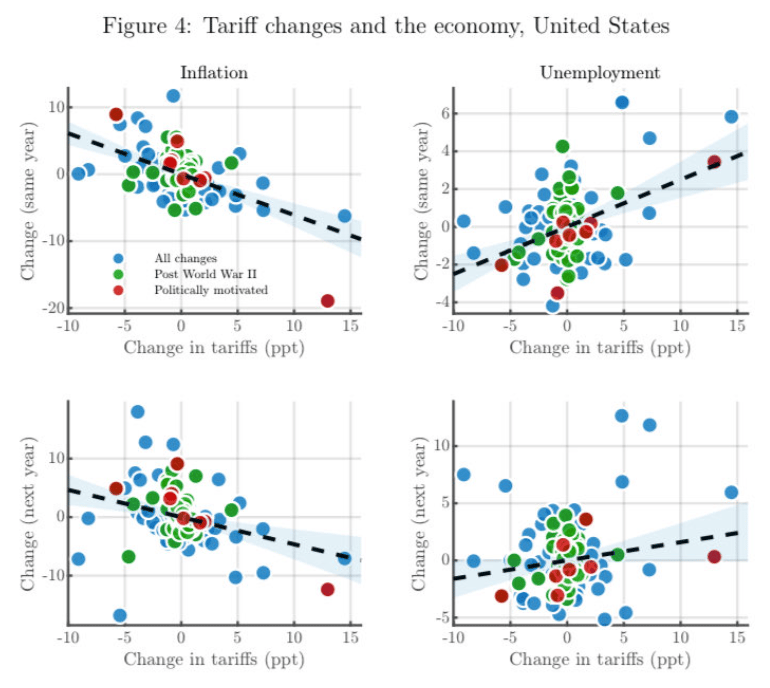

Federal Reserve Bank of San Francisco economists study tariff shocks over 150 years to estimate their macroeconomic effects. They find tariff increases act like negative demand shocks, raising unemployment, lowering inflation, and behaving similarly across the United States, France, and the United Kingdom.

Bonus Content - Long-Run Return Expectations

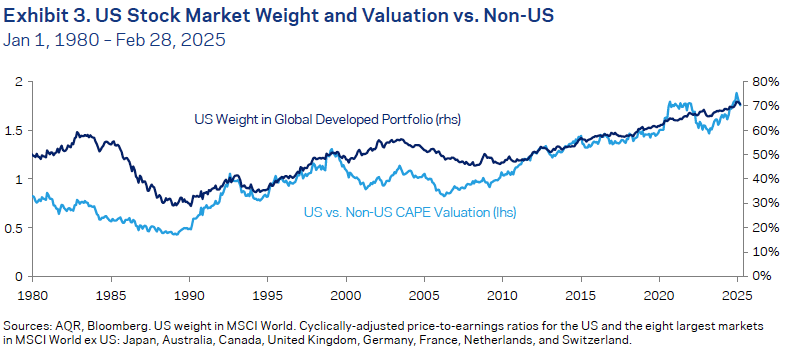

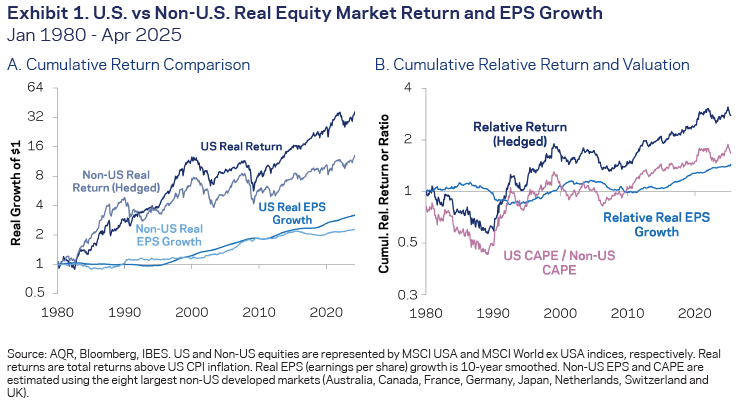

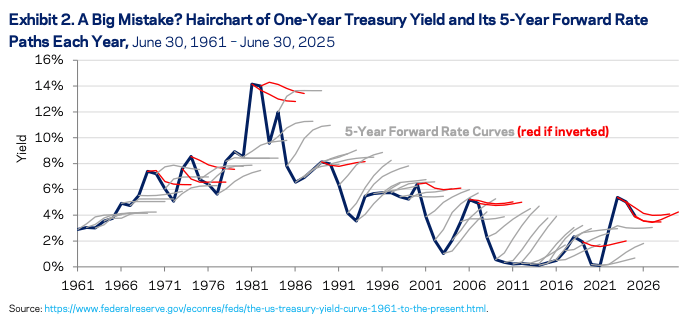

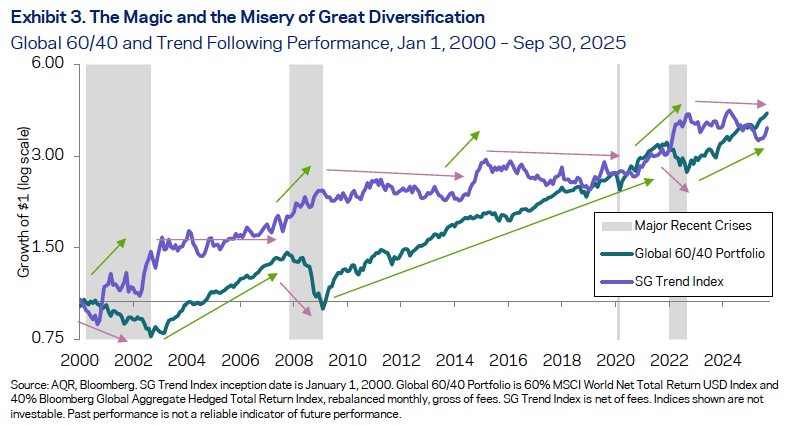

AQR’s Antti Ilmanen published a series of 10 papers, which attempts to understand how investors actually form long-run return expectations. He covers:

The conflict between contrarian objective expected returns (based on yields) and extrapolative subjective expectations (based on recent past returns),

The difference in how investors form long-run expectations in equity and bond markets.

What drives the love/hate relationship between investors and diversifiers.

Here are all ten papers:

Get SOC 2 Compliant & Stuff Your Pipeline

This Thanksgiving, Delve’s cooking up more than turkey—we’re helping you feast on new deals. Get $1,500 off compliance + a $500 Visa gift card when you become SOC 2 compliant before Nov 27.

While your team feasts, don’t let your deals starve. Delve’s AI agents automate SOC 2 evidence, risk checks, and audits—no spreadsheets, no manual chaos, just fast compliance.

Results don’t lie:

Lovable → SOC 2 in 20 hrs

Wisprflow → Signed Mercury & Superhuman in 1 mo

11x → $1.2M ARR unlocked

Use code THANKSGIVING before 11/27 @ 11:59 PM PST.

Podcasts

Sir Chris Hohn discusses investing, his approach to philanthropy, the limits to AI, shareholder activism, and more. |

Cliff Asness discusses market efficiency’s decline, factor investing challenges, and how passive flows and narratives can distort prices. |

Aswath Damodaran discusses equity valuations, market concentration, and why higher rates leave few safe havens for stock investors. |

What Else Is Happening

Did you miss last week’s email?