- The Idea Farm

- Posts

- RIP Small-Caps 🪦

RIP Small-Caps 🪦

+ Rob Arnott, Michael Mauboussin, Jason Zweig, Raj Chetty & More

“The truth is that money only makes you more of what you already are.”

Research

Marquette Associates explains why the rise of private equity has led to the number of companies going public to decline, which has impacted the performance of small-cap stocks and indices like the Russell 2000.

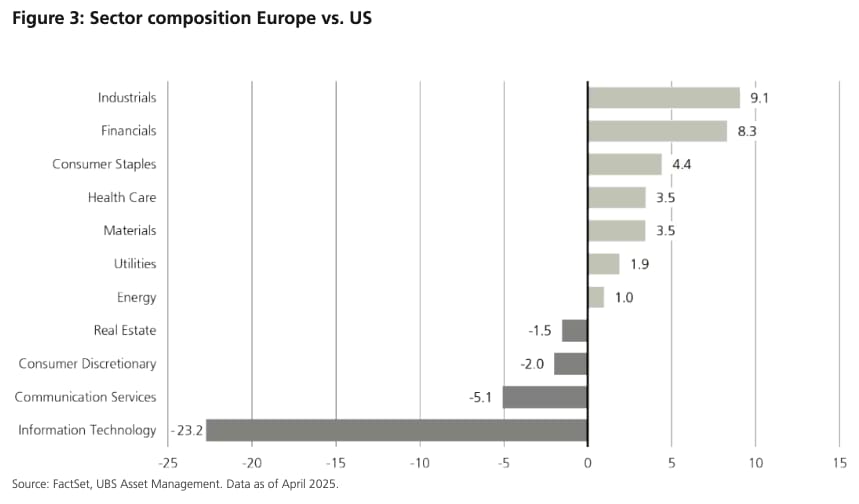

UBS - The Red Thread: Europe Edition (38 pages)

UBS published a booklet on Europe’s economic and investment landscape. The link above has links to each section, or you can download the entire PDF.

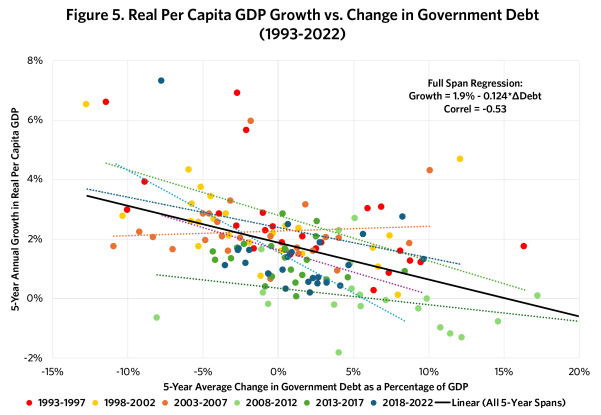

Rob Arnott finds that beyond a certain “sweet spot” (15% to 30% of GDP) government spending imposes a drag on economic growth.

Morgan Stanley - Drawdowns and Recoveries (24 pages)

Michael Mauboussin analyzes historical drawdowns for both stocks and mutual funds. He points out that painful drawdowns exist even in a world with perfect foresight into long-term returns, and then offers some qualitative guidelines for considering which stocks may bounce off the bottom.

The median drawdown for the 6,500 stocks in our sample from 1985-2024 was 85 percent and took 2.5 years from peak to trough. More than one-half of all stocks never recover to their prior highs.

Man Group - GOLD!! (21 pages)

With the price of gold roughly doubling over the past three years, Henry Neville digs into whether or not it’s still a good time to get exposure and his framework for doing so.

Bonus Content

Jason Zweig explains how your memories of what the market has done before can deceive you in dangerous ways. Link

JPMAAM shares 30 important investment insights to celebrate their 30th anniversary. Link

Raj Chetty discusses the factors that impact a child's chances of success and the innovative solutions being developed to bridge the opportunity gap (41 minutes). Link

A risk-averse business culture and complex regulations have stifled innovation in Europe, weighing on its future. Some stats: Link

Over the past 50 years, the U.S. has created, from scratch, 241 companies with a market capitalization of more than $10 billion, while Europe has created just 14.

The typical company in the top 10 publicly traded U.S. firms was founded in 1985, while in Europe, it was in 1911.

In Europe, venture capital tech investment is a fifth of U.S. levels.

Europe has a larger population and similar education levels to the U.S., but only 4 of the top 50 tech companies are European.

Find your customers on Roku this Black Friday

As with any digital ad campaign, the important thing is to reach streaming audiences who will convert. To that end, Roku’s self-service Ads Manager stands ready with powerful segmentation and targeting options. After all, you know your customers, and we know our streaming audience.

Worried it’s too late to spin up new Black Friday creative? With Roku Ads Manager, you can easily import and augment existing creative assets from your social channels. We also have AI-assisted upscaling, so every ad is primed for CTV.

Once you’ve done this, then you can easily set up A/B tests to flight different creative variants and Black Friday offers. If you’re a Shopify brand, you can even run shoppable ads directly on-screen so viewers can purchase with just a click of their Roku remote.

Bonus: we’re gifting you $5K in ad credits when you spend your first $5K on Roku Ads Manager. Just sign up and use code GET5K. Terms apply.

Podcasts

The leader author of Valuation: Measuring and Managing the Value of Companies walks through how companies create shareholder value, what leads managers to not take a long-term approach, & the link between return on invested capital and valuation. |

Investor, businessman, and author Michael Calvey walks through what it was like to be an early tech investor in Russia and later becoming a prisoner of the state. |

This episode explores the complexities and fragilities of successful societies, how specialization can lead to higher living standards but also increased vulnerability, and our existential worries about the future. |

What Else Is Happening

Did you miss last week’s email?