- The Idea Farm

- Posts

- The $250 Trillion Portfolio

The $250 Trillion Portfolio

+ Jared Kushner, Jeffrey Gundlach, Peter Lynch, Aswath Damodaran & More

Sponsored by

“All Investments carry within them the seeds of their own destruction.”

Research

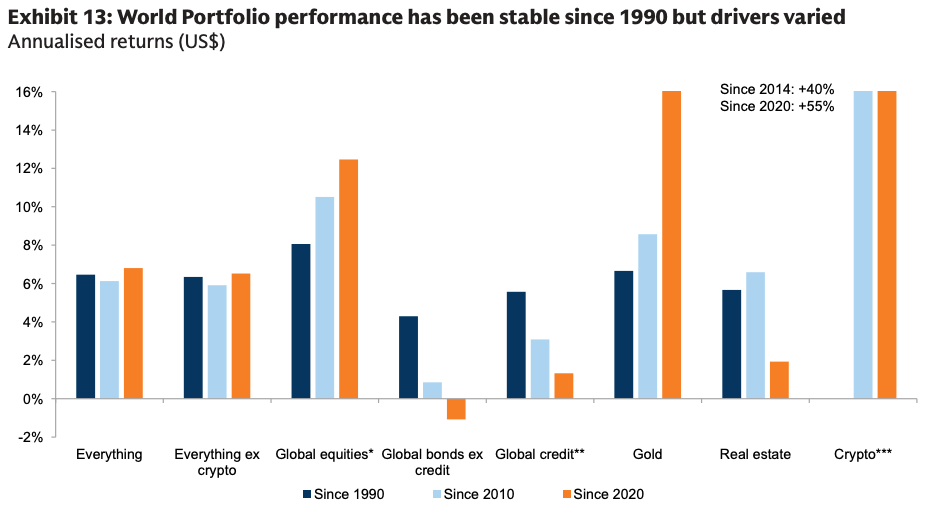

Peter Oppenheimer’s team looks at the World Portfolio, which is the sum of all investable assets globally (estimated to be roughly US$250 trillion, or 200% of world GDP). They highlight three current trends:

The equity weight relative to bonds has increased materially since the Great Financial Crisis, but it remains below levels from the 1990s.

Both in equities and bonds the US has accrued a larger weight and is very dominant.

Alternatives such as private markets, Gold and cryptocurrencies have grown relative to public equities and bonds (but remain relatively small).

Richard Ennis and Dan Rasmussen address criticism of their recent private equity paper.

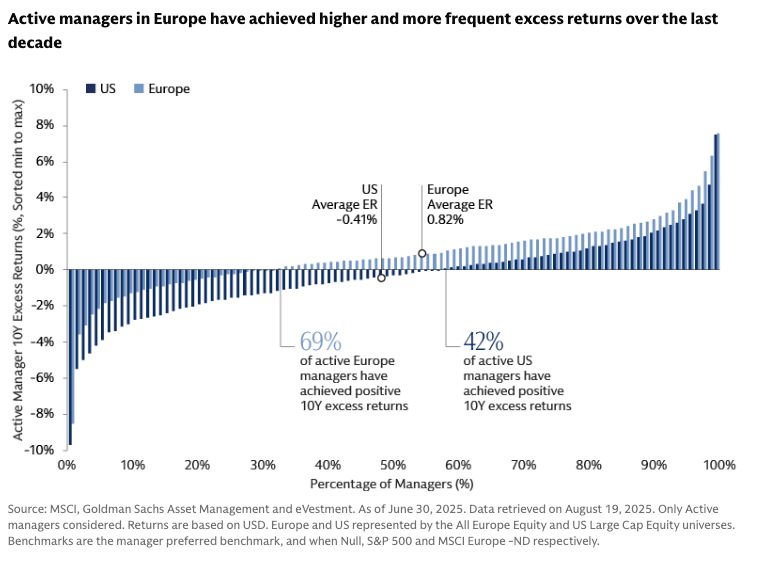

Goldman Sachs - Quantitative Precision: Seeking to Unlock High Alpha Potential in European Equities (20 pages)

Goldman Sachs Asset Management explores how quantitative factor models can uncover alpha opportunities in European equities despite muted regional growth. GSAM highlights that factor dispersion in Europe is at a decade high, enabling systematic strategies focused on quality, value, and momentum to outperform traditional benchmarks amid wide valuation gaps and low investor positioning.

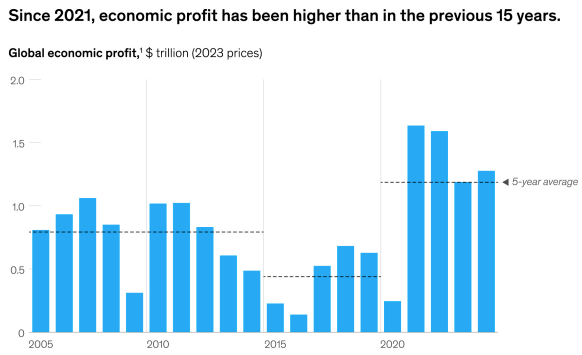

McKinsey & Company reports that global corporate economic profit reached an all-time high of $4.3 trillion in 2024, rebounding sharply from pandemic-era lows. They find that just 20% of companies captured 90% of total economic profit, underscoring widening performance inequality and the growing strategic importance of scale, capital efficiency, and innovation-led growth.

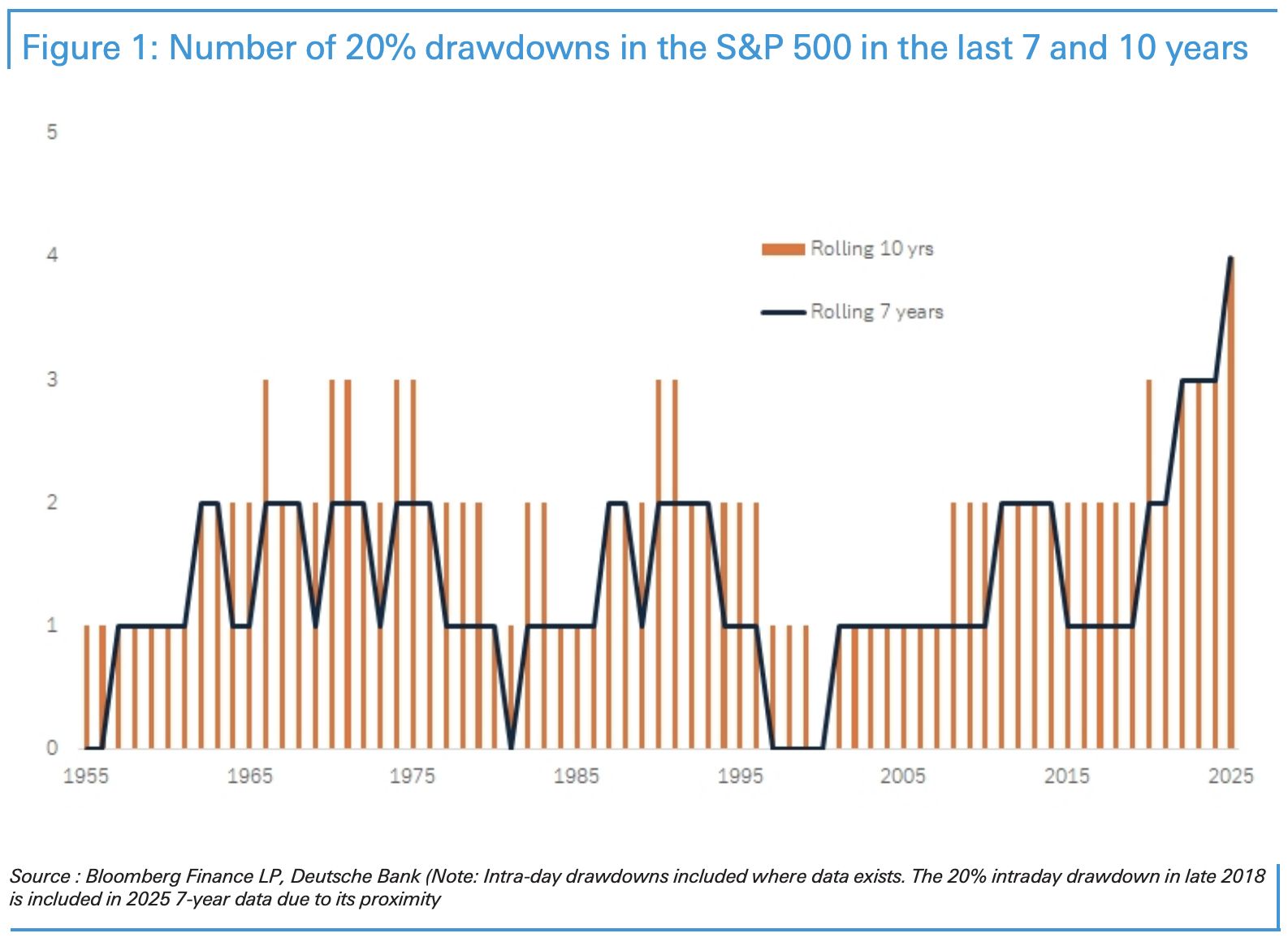

Deutsche Bank warns that investors are underestimating the risk of sudden market shocks from escalating geopolitical tensions. They highlight potential flashpoints including Taiwan, NATO-Russia relations, and the South China Sea, arguing that heightened military contact and global nationalism could trigger self-reinforcing risk-off events even without direct conflict.

Schroders Equity Lens (58 pages)

Schroders notes that U.S. equity markets remain sharply divided, with speculative technology stocks and the “Magnificent Seven” driving gains while most other sectors lag. The summary also highlights record-high valuations across global markets, rising emerging-market multiples, and a historic surge in share buybacks in the UK and Japan.

Bonus Content

Ulrike Hoffmann-Burchardi, UBS CIO & Global Head of Equities, shares an update on her 10 AI views. Link

Cambria makes the case for a U.S. equal weight approach. Link

Henry Neville touches on inflation, valuations and sentiment. Link

Given Jerome Powell’s recent comment that US equities are “fairly highly valued,” Professor Aswath Damodaran examines whether markets are overpriced, and if so, whether action is warranted. Link

Turn RAG into riches with Delve’s AI for security questionnaires

Hate those endless security questionnaires? We do too. So we hired the sharpest AI brains from Stanford, MIT, and beyond—and made them do your grunt work. Delve uses state-of-the-art agentic RAG, not your average “retrieve + answer” hack.

Our agents think ahead: pull evidence, resolve conflicts, reason across your policy graph, interrogate your infrastructure, and draft bullet-proof responses. We’ve helped Lovable, Bland, Micro1 and a ton of the fastest-growing AI companies navigate and close review with almost every F50 - and saved dozens of hours with our AI-native compliance platform.

*Get $1,000 off SOC 2, HIPAA, GDPR and more - and automate security questionnaires away forever. use IDEAFARM1KOFF for 1K off.

Podcasts

Jeffrey Gundlach discusses the current market and macro environment, including thoughts around the economic impacts of artificial intelligence, the path forward for monetary policy, fixed income markets, and broader asset allocation. |

Peter Lynch’s investing journey highlights his “invest in what you know” philosophy, focus on fundamentals, and disciplined approach to long-term success. |

Jared Kushner talks about founding Affinity Partners, lessons from public service, and his perspective on global investing opportunities. |

What Else Is Happening

Carl Richards shares insights on improving financial decision-making, overcoming behavioral biases, and developing a healthier relationship with money. |

Did you miss last week’s email?