- The Idea Farm

- Posts

- Biotech Bonanza

Biotech Bonanza

+ John Arnold, Owen Lamont, Jeremy Grantham, Edward Chancellor, Helima Croft & More

Sponsored by

“Avoid having your ego so close to your position that when your position falls, your ego goes with it.”

Research

Verdad - Biotech Investing (29 pages)

Dan Rasmussen suggests biotech can be both diversifying and investable if you treat it like a data problem, not a story stock sector. It highlights the harsh base rate, with 67% of biotechs losing money, and proposes a disciplined quantitative approach to separate signal from trial driven noise.

Dan discussed this paper alongside biotech investor. D.A. Wallach on The Meb Faber Show this week. Listen | Watch

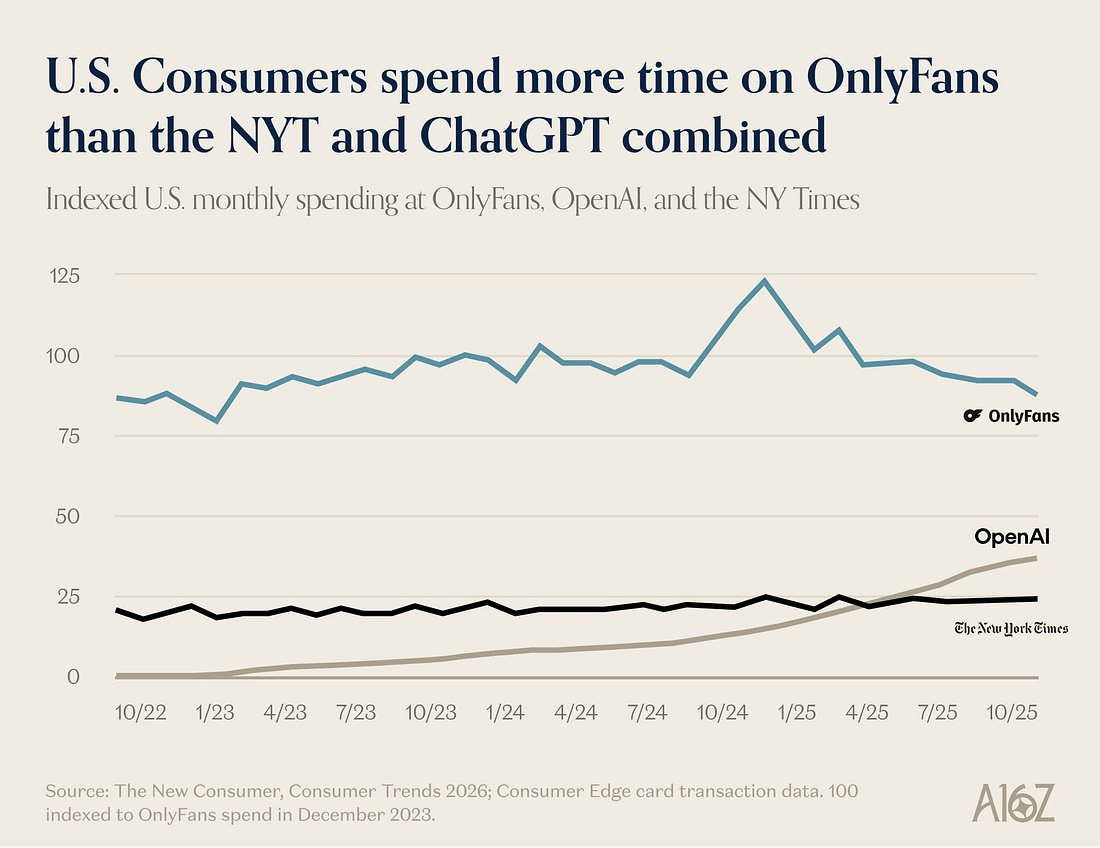

A16Z - State of Markets (57 pages)

a16z’s report looks at trends across public and private markets, with a focus on on venture markets and tech stocks.

In this two-part piece, GMO’s Jeremy Grantham and financial historian Edward Chancellor examine today’s AI boom through the lens of market history.

Bain & Company - Global M&A Report 2026 (91 pages)

Bain’s annual M&A report shares deal value rose in 2025 to deliver the second-highest year on record in a broad-based rebound that spanned all industries. Behind this resurgence is the urgent need for companies to reinvent themselves to get out ahead of the big forces of technology disruption, a post-globalization economy, and shifting profit pools.

Jim Masturzo says markets in a high temperature regime show unpredictable correlations and return patterns compared with stable low volatility environments. He suggests adapting portfolios to structural shifts rather than relying on historical risk premia assumptions.

Bonus Content

Owen Lamont sees bubble-like beliefs and inflows, but says the key missing ingredient is equity issuance, with buybacks still dominating new supply. Link

John Arnold shared some thoughts from his first trip to China to learn about energy and robotics. Link

The Land Report 100 shares the top 100 private landowners in the US. Topping the list in 2026 is Stan Kroenke, who controls an estimated 2,700,000 acres nationwide. Link

A recent study found that “the ETF tax efficiency has increased long-term investors’ after-tax returns by 1.05% per year relative to mutual funds in recent years.” Link

Carta’s "State of Startups” maps how venture backed startups are financing, diluting, and hiring as the market finds its footing again. Link

The problem isn’t performance - it’s complexity

Many investors are sitting on portfolios built over years - tax-loss harvested accounts, legacy ETFs, inherited positions - that are diversified on paper but messy in practice. Selling means taxes.

Doing nothing means complexity.

A 351 exchange offers another path: qualifying portfolios can be exchanged into a newly formed ETF, potentially simplifying holdings while deferring taxes at the time of exchange.

It’s a niche solution - but for the right portfolio, it can be a powerful reset.

Visit the Alpha Architect 351 Education Center to learn how 351 exchanges work and explore our upcoming 351 exchange fund.

Podcasts

Helima Croft, Head of Global Commodity Strategy at RBC Capital Markets, analyzes geopolitics of energy in a world reshaped by wars in Ukraine and the Middle East, OPEC+ policy shifts, and the increasing but volatile drive toward decarbonization. |

Jeff Currie explains the metals surge, commodity supply constraints, and how the energy transition reshapes demand. |

Pippa Malmgren explains Arctic geopolitics, Greenland’s strategic value, and how great-power competition reshapes trade routes and resources. |

What Else Is Happening

Meb Faber discusses markets at extremes, valuation signals, and diversifying beyond traditional stocks. |

Meb, Dan & D.A. discuss biotech’s surge since their last episode, China’s entrance into the biotech space, the IPO landscape, US valuations and productivity, Japan and more. |

Did you miss last week’s email?