- The Idea Farm

- Posts

- Financial Repression Returns

Financial Repression Returns

+ Russell Napier, Greg Jensen, Rick Rule, Michael Mauboussin & More

“Ours is not to reason why; Just correctly sell and buy.”

Research

Morgan Stanley - Who Is On the Other Side? (97 pages)

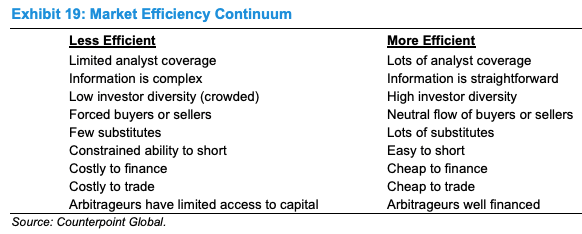

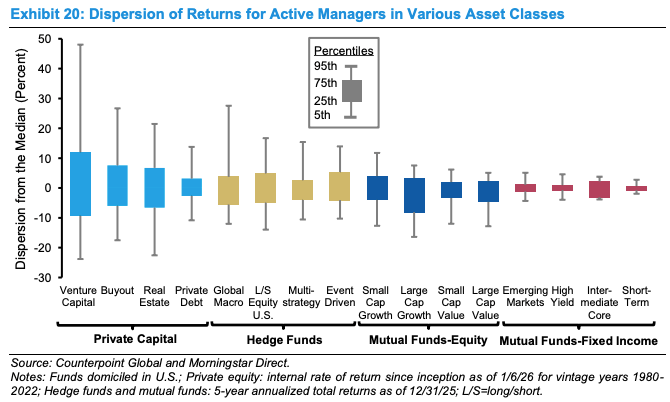

Michael Mauboussin reviews how markets have changed, including flows from active to passive funds, more short-term focus within active, and the rise of retail. He encourages active investors to ask and answer the question, “Who is on the other side?”

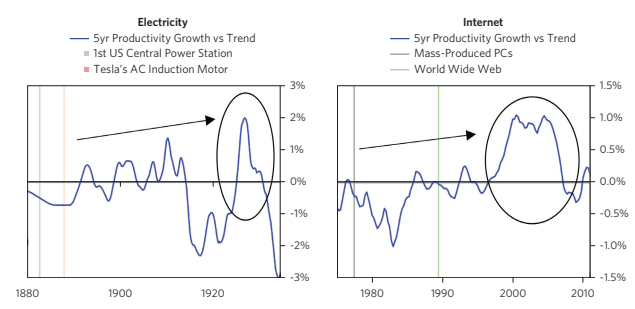

Greg Jensen believes AI capex is set to significantly support US growth in the coming years and many of the second-order consequences of this investment are not priced in.

Goldman Sachs - US Resilience Resilient (144 pages)

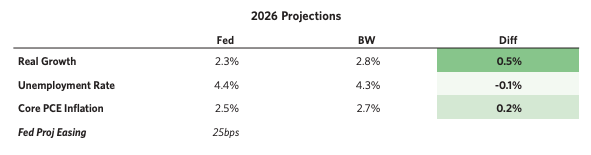

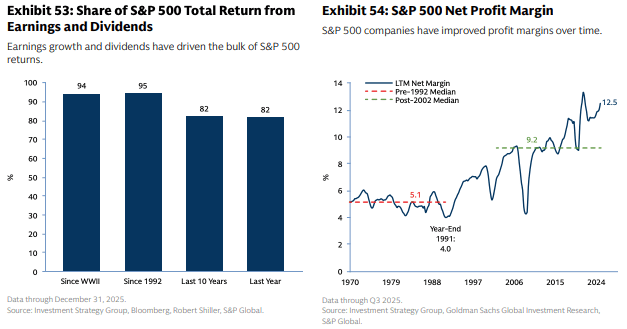

Goldman Sachs’ Investment Strategy Group expects US resilience to stay intact in 2026, supporting a stay invested posture with a US equity tilt. They views policy noise as real but believes checks and balances still function, so investor discipline matters more than trying to time headlines.

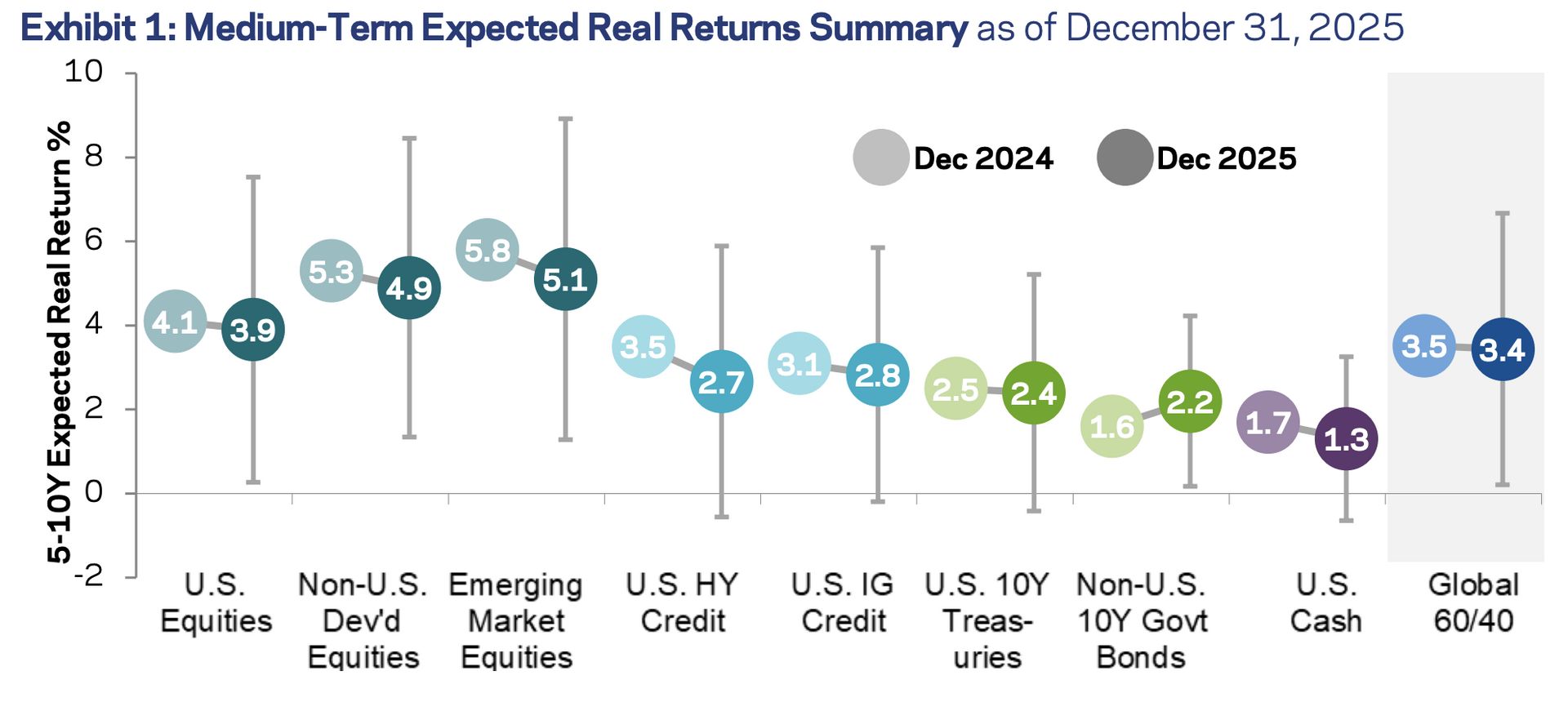

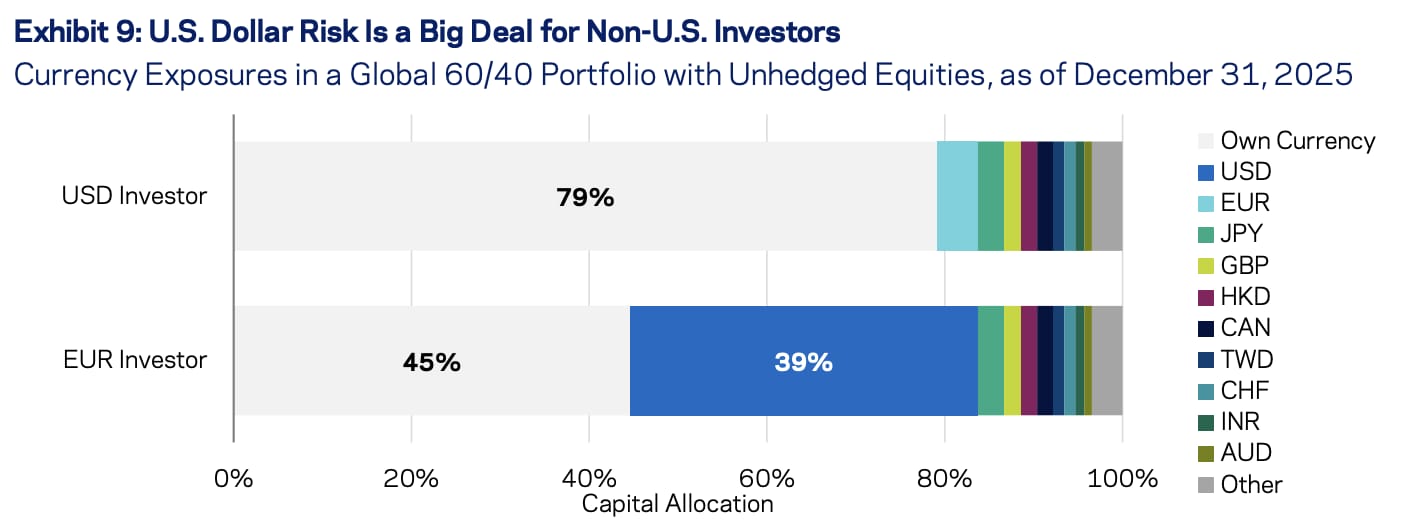

AQR published capital market assumptions for major asset classes with a focus on medium-term expected returns. This year’s article also includes a discussion on currency risk and currency hedging.

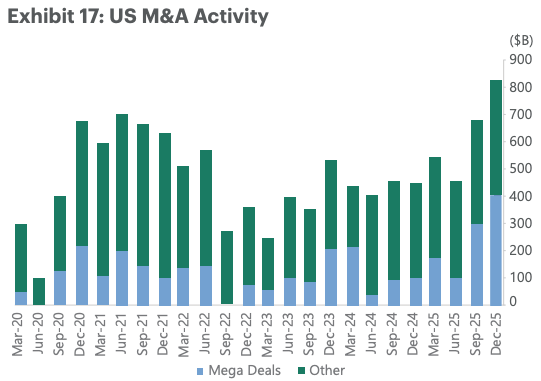

Apollo argues credit is shifting into a buyers market as supply rises from AI financing and renewed M&A activity. They expect cumulative AI related spending above $2.7 trillion through 2029, making issuer selection and true diversification more valuable.

Bonus Content

Reminder: Our refreshed website has 20+ annual reports recently published. Link

Adam Posen and Lazard CEO Peter Orszag think inflation could exceed 4% by the end of 2026. Link

Nat Bullard’s annual presentation on the state of decarbonization and energy markets. Link

Schroders Equity Lens for January is your go-to chartbook to global equity markets. This edition highlights the signs of a “healthy” bull market and explains how to hedge against AI risk without selling equities. Link

Long-term winners seldom outperform like clockwork. Instead, investors should focus on funds’ other traits. Link

J.P. Morgan’s year-end Guide to the Markets have been published for EMEA, the UK, Latin America & Asia.

Podcasts

Tyler Rosenlicht talks about the general ideas behind infrastructure investing, how he thinks about the ongoing boom in energy demand, and how grid bottlenecks shift profits across the energy value chain. |

Cliff Asness explains how bubbles form, why modern investing increasingly resembles gambling, and what the dot-com era can teach us about today's markets. |

Rick Rule explains why he sold most of his silver, what he expects for energy and uranium markets, and how to size commodity exposure. |

What Else Is Happening

Napier explains why he believes we’re going through the end of the existing global monetary system, why gold may be signaling what comes next, and his asset allocation advice. |

Next week on The Meb Faber Show: Dan Rasmussen & D.A. Wallach return. Subscribe so you don’t miss it: Apple | Spotify | YouTube

Did you miss last week’s email?