- The Idea Farm

- Posts

- Gold Rush 2.0

Gold Rush 2.0

+ Campbell Harvey, Ray Dalio, Bill Ackman, Jason Zweig, Ben Inker & More

Sponsored by

“The ordinary human being does not live long enough to draw any substantial benefit from his own experience. And no one, it seems, can benefit by the experiences of others. Being both a father and teacher, I know we can teach our children nothing . . . Each must learn its lesson anew.”

Research

GMO - A Second Opinion on the 60/40 Default (10 pages)

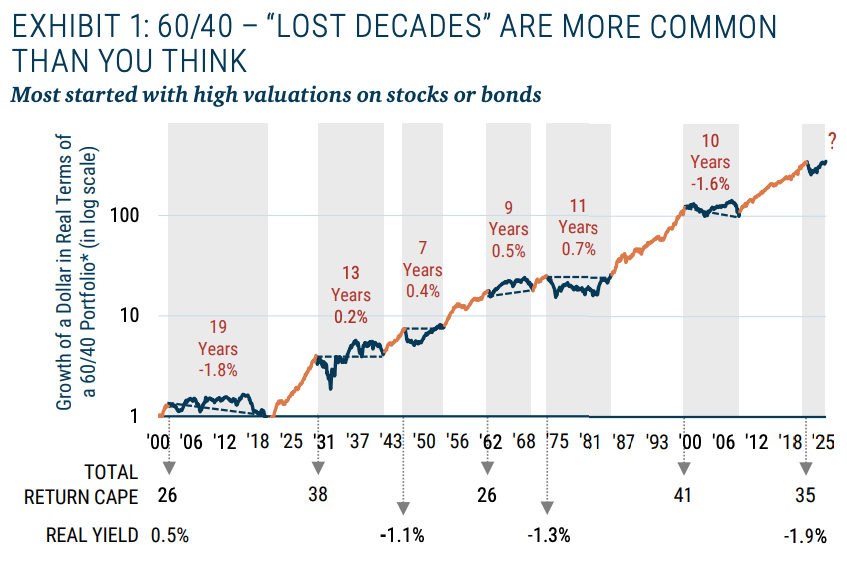

GMO warns a static 60/40 may disappoint from today’s valuations, with the US CAPE Ratio near 31 and the 10 year real yield about 1%. They analyze 120 years of results for a 60/40 portfolio and make suggestions for investors to avoid the possibility of a lost decade (highlighted below).

As of 6/30/2025 | Sources: GMO, Bloomberg, Global Financial Data (early history), Factset (S&P500 returns and CPI), J.P. Morgan (J.P. Morgan GBI United States Traded), Shiller data, Federal Reserve Bank of Philadelphia (U.S. Treasury Yields and Long-term Inflation Expectations). Real yield is the yield on the 10-Year U.S. Treasury minus Philly Fed Long-Term Inflation Expectations (1992-present) or the 12-month trailing CPI (early history). Current CAPE = 31 and Real Yield = 1.0%. 60% U.S. Equities (S&P 500), 40% U.S. Bonds (U.S. Treasuries) rebalanced monthly.

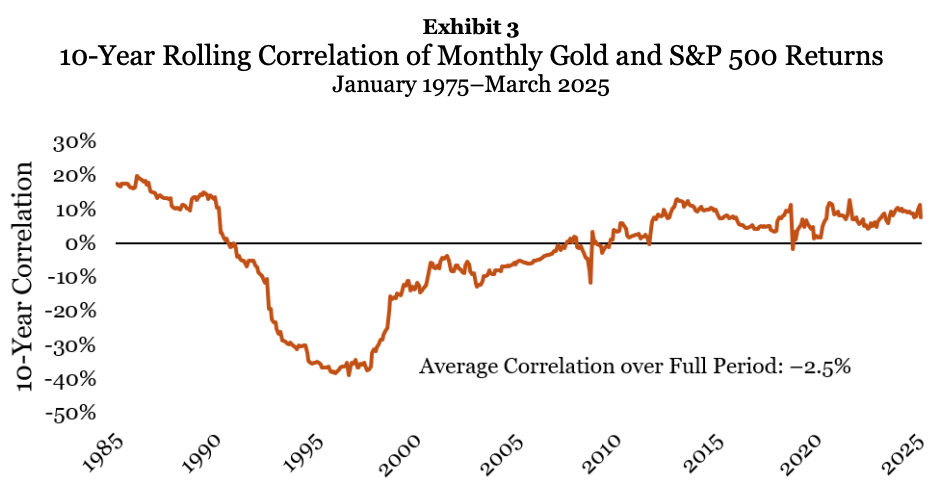

The authors analyze gold’s hedging value, the forces behind its record price, and its long-run return prospects. They argue financialization, de-dollarization, and possible Basel III treatment could boost demand even as high real prices imply low future returns.

Factoring in the Low-Volatility Factor (52 pages)

Low-volatility stocks have historically delivered higher risk-adjusted returns than their high-volatility peers. The authors advocate integrating the low-volatility factor into asset pricing models, accounting for the asymmetry and frictions.

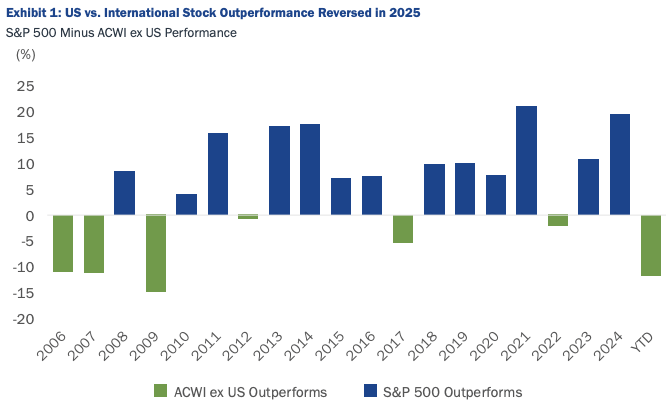

Jennison Associates makes the case that, despite generating relatively strong performance through mid-2025, international growth equities remain historically inexpensive. Passive ACWI ex US tilts 61% to cyclical sectors, making secular growers a great opportunity for bottom up, fundamental investing.

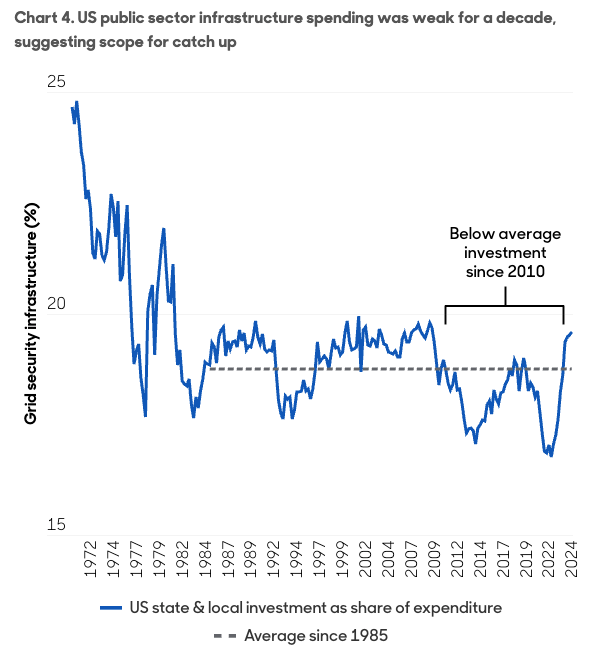

Aberdeen estimates that global infrastructure investment needs will surpass $130 trillion by 2050, driven by decarbonization, digitalization, and demographic trends. The firm believes that private capital will be essential to closing the funding gap, with renewables, transportation, and digital infrastructure offering the strongest long-term investment potential.

Bonus Content

Stock buybacks are booming in 2025. That may be bad news for dividend investors. Link

Ray Dalio discusses his perspective on gold in light of its strong year-to-date performance. Link

Lawmakers are considering a bill that would allow retirement accounts to skip reporting the expenses of certain funds they may invest in. Link

The current outperformance by the largest stocks (10.5 years) is the second longest period since 1900. Link

A 351 ETF Exchange could transition an investment positions with significant gains into an ETF, without facing a large tax bill. Link

Don’t Let SOC 2 Kill Your Startup

A startup was on the rise—steady growth, happy customers, investors circling. Then a big prospect asked for SOC 2. They signed up with one of the big platforms. Suddenly: endless tasks, confusing checklists, engineers pulled off product. Deals stalled. Competitors moved in.

Those competitors? They used Delve.

15 hours later, they were audit-ready and closed the deal. The first startup never recovered. One by one, their deals slipped away. Keys handed over. Game over.

Don’t be that startup. Delve automates compliance—SOC 2, ISO 27001, HIPAA, GDPR, PCI-DSS and more—so you’re ready in days, not months.

Today, compliance is done in Delve.

Book a demo, use IDEAFARM1KOFF for 1K off.

Podcasts

Build‑A‑Bear’s CEO explains how she reinvented a mall staple by returning the company from a $49 million loss to sustained profits by expanding into digital, adult, and licensing channels. |

Bill Ackman shares how he built Pershing Square into a $30 billion firm, his evolving investment philosophy, and his team’s approach to risk, activism, and concentrated investing. |

Alexander Iguchi talks about his investment philosophy, buying quality companies at deep discounts and actively forcing a catalyst. He explains how how private-equity trusts and buybacks can unlock value and touches on opportunities in Asia, Europe and the US. |

What Else Is Happening

Did you miss last week’s email?