- The Idea Farm

- Posts

- Not in a bubble... yet

Not in a bubble... yet

+ Tobi Lütke, Dan Morehead, Kai Wu, Bridgewater, Coatue, Goldman Sachs & More

“The only thing that really matters in asset allocation is sidestepping some of the pain when the rare, great bubbles break.”

Research

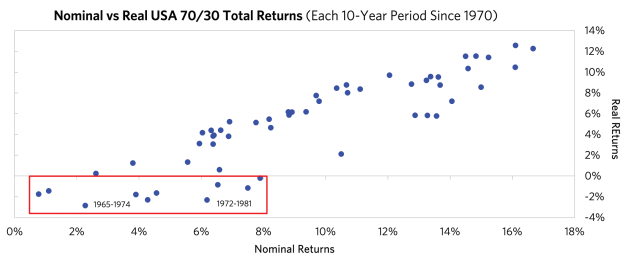

Peter Oppenheimer explains why he believes the markets show froth but aren’t quite yet in bubble territory. He does argue that high levels of market concentration and increased competition in the AI space suggest investors should continue to focus on diversification.

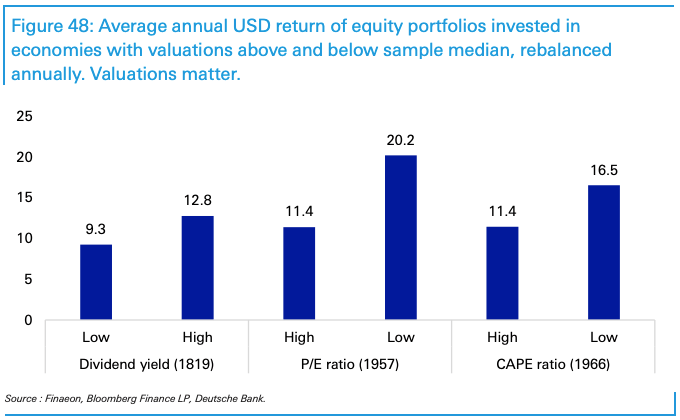

Jim Reid published the 20th anniversary edition of Deutche Bank’s flagship Long-Term Study, which examines how asset classes (mainly global stocks and bonds) have performed across a wide range of macroeconomic, policy, and valuation environments, drawing on data all the way from the 18th century to today.

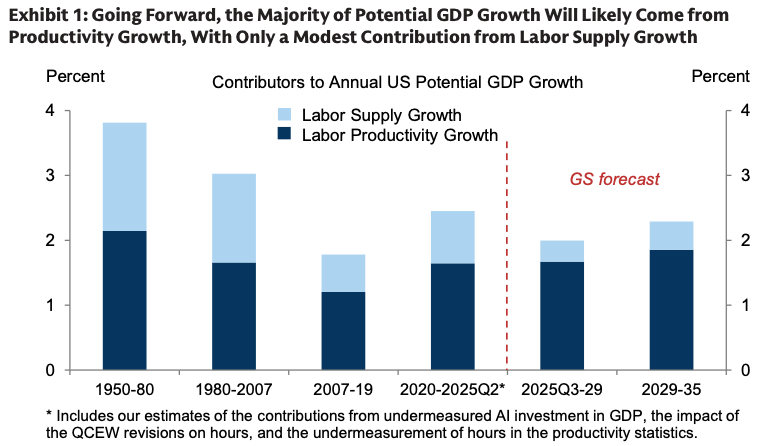

Goldman Sachs - Jobless Growth (15 pages)

Jan Hatzius’ team looks at the state of the labor market and considers the potential macro, monetary policy, and market implications of rapid technological progress. They say the key question is whether labor demand growth is and might remain too weak to keep up with even modest labor supply growth.

Bridgewater Associates argues the world is entering a new era of higher inflation risk driven by persistent fiscal deficits, supply constraints, and geopolitical fragmentation. They suggest investors reduce their reliance on traditional stock bond diversification.

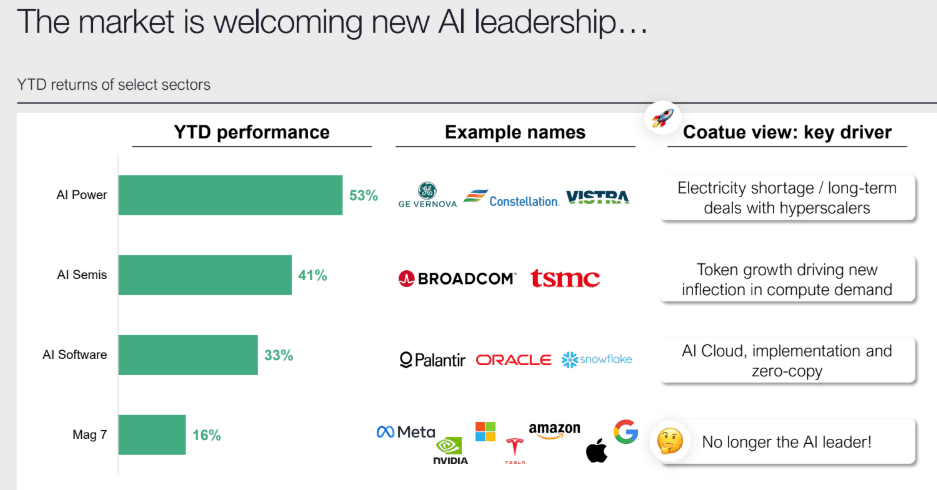

Coatue - Public Markets Update (59 pages)

Coatue’s market update has four key takeaways:

They remain bullish on AI

2026 will be the year of AI apps, and the ROI is here

The macro environment is supportive of market strength

They know trees don’t grow to the sky, and will always manage downside

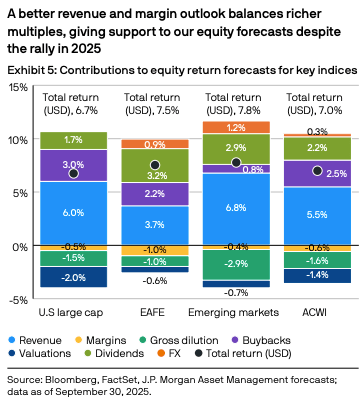

J.P. Morgan Asset Management’s 2026 Long-Term Capital Market Assumptions provides return and risk expectations for more than 200 assets and strategies in 20 base currencies.

Kai Wu finds historical capital expenditure booms have typically resulted in overinvestment, excess competition, and poor stock returns. With the AI arms race transforming Big Tech from asset-light to asset-heavy, he suggests rotating toward a broader set of AI beneficiaries with lower capital requirements and valuations.

Podcasts

The world’s largest gaming-focused investor covers everything associated with the sector, including the impact of AI, why AR/VR is overrated, and where he sees opportunities. |

Tobi Lütke talks about Shopify’s evolution, lessons on innovation and implementing AI, and how to stay ahead by living in the future. |

Tiger Cub Dan Morehead shares his perspective on crypto as a long-term asymmetric opportunity, discussing blockchain adoption, market cycles, and institutional participation. |

This episode covers covered call strategies—popular ETFs often marketed on their distribution yields. It explains while they may promise steady “income,” the reality is more complicated. |

What Else Is Happening

Did you miss last week’s email?