- The Idea Farm

- Posts

- Retail Frenzy Meets Market Peaks

Retail Frenzy Meets Market Peaks

+ Carlyle, Citadel, Goldman Sachs, Man Group, Pet Spending & More

Sponsored by

“If it is obvious, it is obviously wrong.”

Research

Goldman Sachs - Productivity Stagnation in the Construction Industry: An International Perspective (20 pages)

Goldman Sachs explains why US construction has become a rare sector where productivity has declined over time, unlike the broader economy. It suggests regulation, slow innovation, and measurement issues help explain persistent housing shortages and high building costs.

Carlyle summarizes the current state of the private markets, highlighting strong deal activity in 2025 and resilient credit markets. Net distributions from global buyout funds surged in Q3 2025 to $21.5 billion, more than 5x the amount of the prior quarter and the strongest quarter since Q4 2021.

Citadel - February (21 pages)

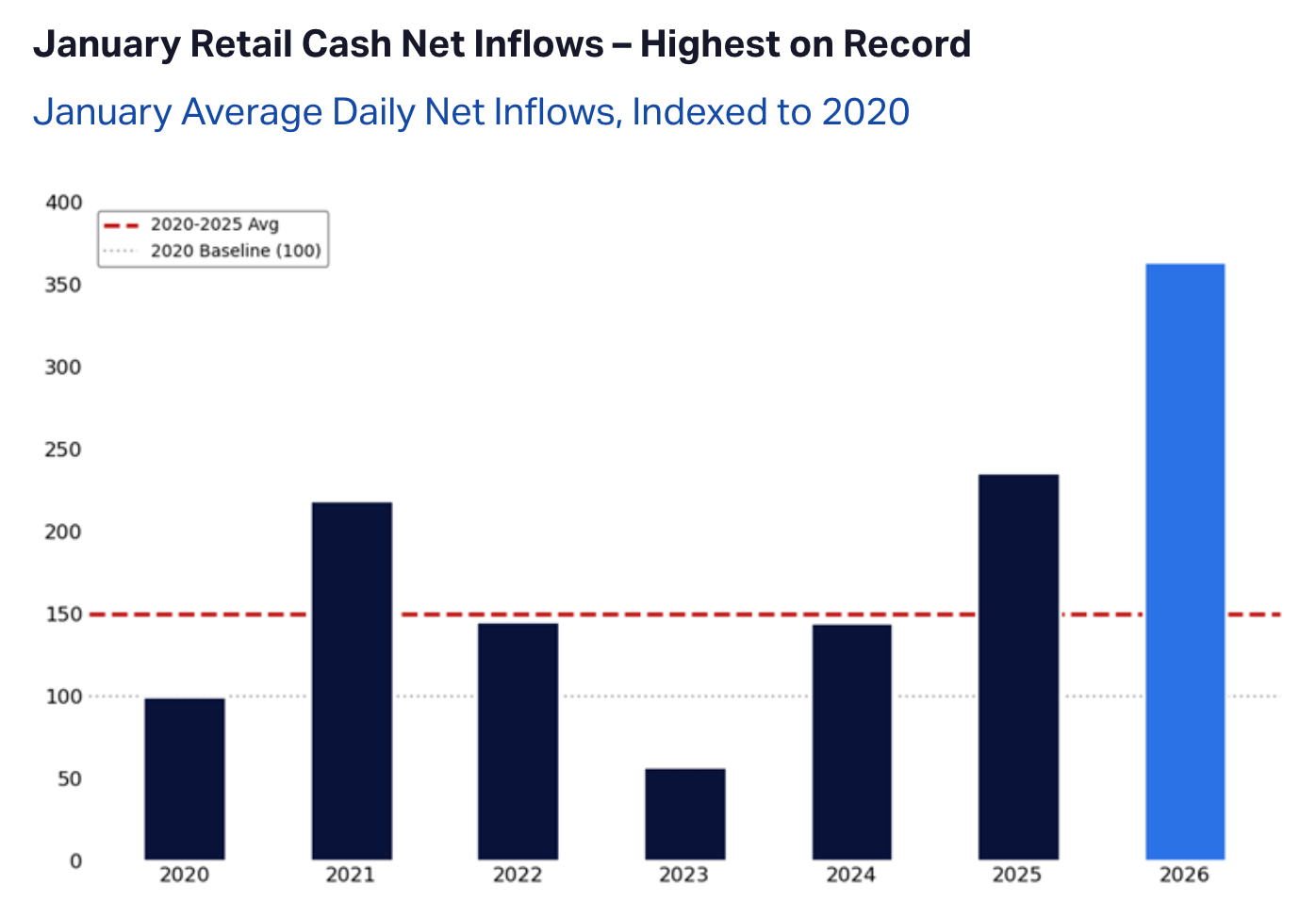

Citadel’s Scott Rubner says retail equity and options activity has stayed significantly elevated in 2026, with retail buyers showing persistent net buying behavior and average daily flows much higher than recent years. He also highlights broadening sector leadership and increased breadth under the surface of headline indices.

Henry Neville looks at the history of stock market peaks and finds three things make a drawdown more likely: a lack of volatility, inflation that is too high or too low, and expensive valuations.

Schroders examines the recurring gap between perceived economic “miracles” and actual investor returns. They highlight that valuation, sentiment, and thematic leadership can change quickly, making discipline and repeatable processes more important than chasing narratives.

Bonus Content

As the breadth of returns has started to expand beyond mega-cap leaders, S&P Global examines equal-weight strategies. Link

John Authers says the market isn’t selling off, but rather it is seeing a rotation into companies that stand to benefit from a resilient economy. Link

Yale University's endowment set the standard for investment performance with its focus on private equity and other illiquid fare. Now that model is falling behind a more traditional strategy. Link

Capital One shared pet spending statistics: The average American pet owner spent $2,026 on their pet(s) in 2024. Link

The February 2026 edition of the Schroders Equity Lens includes a section on Magnificent-7 fundamentals. Link

Beezer Clarkson says the venture capital industry is seeing the first meaningful industry-wide contraction in over 20 years. Link

Emerging Markets Shareholder Yield

The Cambria Emerging Shareholder Yield ETF focuses on high-cash distribution companies located in emerging markets.

EYLD’s process goes beyond focusing on just dividends alone to include buybacks and debt paydown, a trio collectively known as shareholder yield. The result is a portfolio of companies that rank highly on shareholder yield and offer strong free cash flow characteristics.

Get emerging markets exposure with companies focused on dividends and buybacks with the Cambria Emerging Shareholder Yield ETF, EYLD.

Distributed by ALPS Distributors, Inc. Investing involves risk, including possible loss of capital. To determine if this Fund is an appropriate investment for you, carefully consider the Fund's investment objectives, risk factors, charges and expense before investing. This and other information can be found in the Fund's full or summary prospectus which may be obtained by calling 855-383-4636 (ETF INFO) or visiting our website at www.cambriafunds.com. Read the prospectus carefully before investing or sending money.

Podcasts

Louis-Vincent Gave says the most consequential and under appreciated macro developments today is the mispricing and policy shift of the Chinese renminbi. |

This episode breaks down how equal-weighted indices differ fundamentally from traditional market-cap-weighted indexes and why equal weighting has historically outperformed in certain periods. |

This is the story of Preston Johnson and a group called WAGMI United and their idea to buy an English football club and then use NFT sales to fund player spending. |

What Else Is Happening

Deutsche Bank’s Jim Reid distills inflation regimes, equity-bond cycles, and lessons for long-term asset allocation. |

Did you miss last week’s email?