- The Idea Farm

- Posts

- Short-Termism 👉 Mispricings

Short-Termism 👉 Mispricings

+ Ray Dalio, Citadel, Scott Goodwin, Scott Belsky, Dan Wang & More

Sponsored by

“I would recommend zero exposure to the US, but if you have to own US stocks, own quality stocks.”

Research

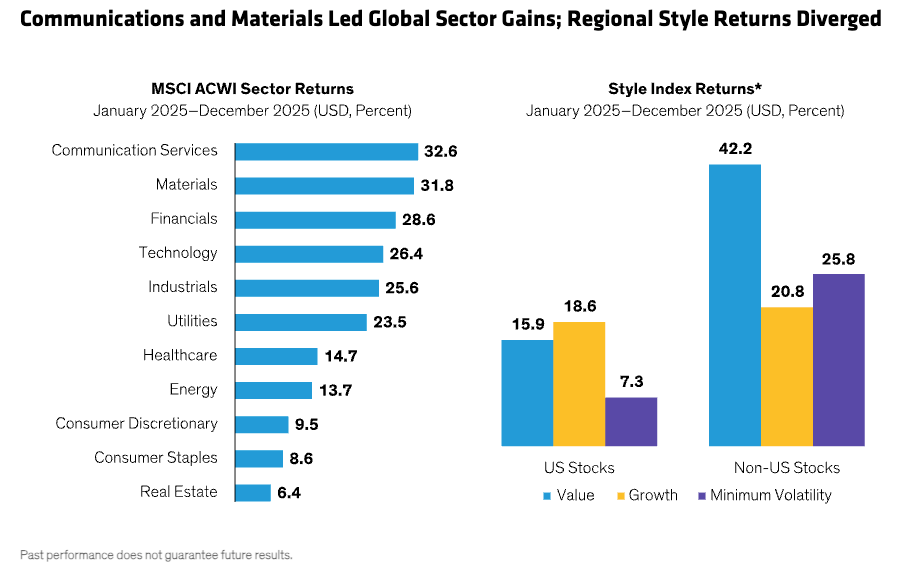

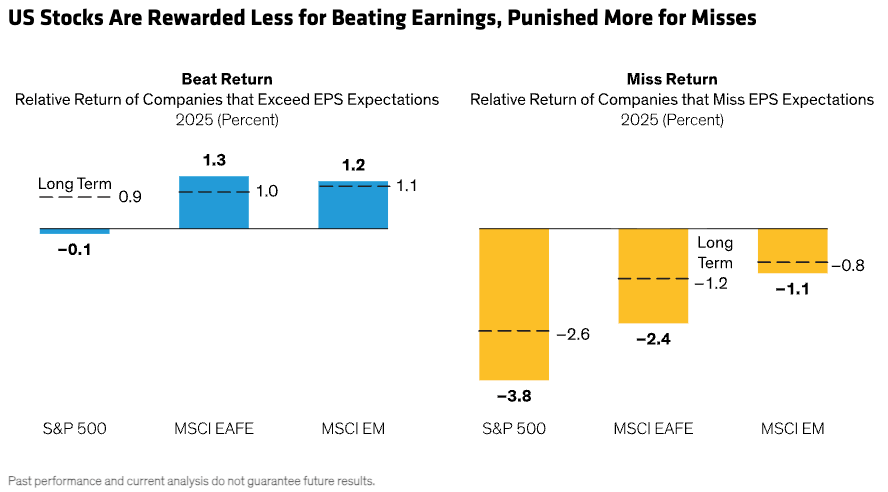

AllianceBernstein maps a wider set of equity return drivers for the year ahead, urging investors to diversify beyond US mega cap tech and plan for volatility. They point out global equities rose 22.3% last year, showing leadership can broaden across regions and styles.

Citadel Securities - 2026 – Q1 Outlook (24 pages)

Citadel’s Scott Rubner says the U.S. economy enters 2026 with resilient growth, broadening profit drivers and a policy mix that remains supportive of risk assets. He highlights five main pillars that he believes will shape early-2026 market behavior.

He also elaborated on these themes earlier this week.

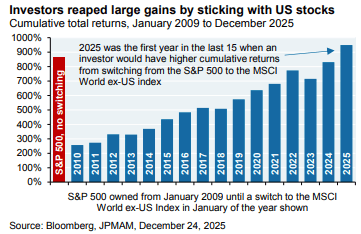

From 2009 to 2024, the S&P 500 generated 3.6x the return of the MSCI World ex-US Index. In 2025 the US finally underperformed most equity markets, leaving the S&P 500 vs rest of world multiple since 2009 at 3.0x.

Michael Cembalest’s outlook focuses on four medium term risks: US power generation constraints, China scaling the moat on its own, Taiwan and a “metaverse moment” for hyperscaler profits after $1.3 trillion of capex and R&D.

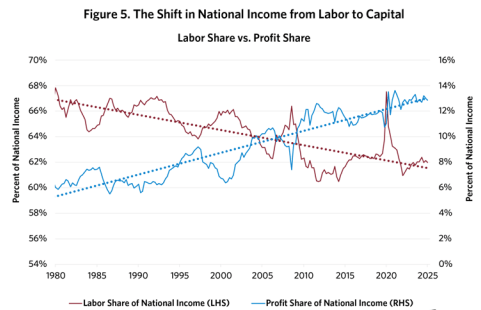

Research Affiliates - Financialization: How Deficits Inflate Profits and Equity Valuations (10 pages)

Research Affiliates argues chronic fiscal deficits can flow almost one for one into corporate profits, then passive indexing mechanically capitalizes those profits into higher valuations, leaving equities exposed if fiscal support fades.

The authors analyze how institutional short-termism leads to predictable mispricing, showing that firms held by long-horizon investors earn higher returns due to reduced myopia and longer holding periods.

Bonus Content

J.P. Morgan published their year-end Guide to the Markets. Link

The Trump Administration published their 2025 National Security Strategy. Link

Dan Wang, who previously covered tech for Gavekal Dragonomics is the author of Breakneck: China's Quest to Engineer the Future, wrote his 2025 annual letter. Link

Scott Belsky shared 12 things he expects to see in the coming yearish. Link

A mystery trader made $400,000 betting on Maduro’s downfall, doubling down with a final bet on Polymarket at 9:58 p.m., shortly before President Trump ordered the military to strike. Link

Ray Dalio looks back at 2025. Link

“While most people see US stocks and particularly US AI stocks to be the best investments and hence the biggest investment story of 2025, it is indisputably true that the biggest returns came from 1) what happened to the value of money and 2) US stocks significantly underperforming both non-US stock markets and gold.”

When Tax-Loss Harvesting Becomes Portfolio Deadweight

Many tax-loss harvesting portfolios eventually reach a dead end: the losses are gone, contributions have stopped, and what remains is a web of small positions and legacy ETFs.

For portfolios like this, a Section 351 exchange may offer a path to consolidation without triggering capital gains at the time of exchange, if eligibility requirements are met.

Alpha Architect takes an education-first approach to 351 exchanges. Our 351 Education Center includes short videos, visual walkthroughs, and practical resources designed to help advisors understand how these exchanges work—and when they may or may not apply.

Explore Alpha Architect’s 351 Education Center to see how 351 exchange funds are being used to address “finished” TLH portfolios and other complex scenarios.

Podcasts

Eli Lilly’s Dave Ricks discusses drug innovation, scaling a healthcare giant, and balancing pricing and patient access. |

Diameter Capital’s Scott Goodwin talks about his career, his investment philosophy, and how he’s navigating opportunities across the credit spectrum. |

Thomas Stephens discusses his evolution from losing bettor to professional sports bettor, lessons learned, and the realities of the industry. |

What Else Is Happening

Did you miss last week’s email?

The Meb Faber Show featured episodes with 15 authors in 2025. Check out the full list of books and episode links.