- The Idea Farm

- Posts

- The King (Gold) Stays the King

The King (Gold) Stays the King

+ Seth Klarman, Andrej Karpathy, Logan Mohtashami, Luke Gromen & More

“Most investors tend to cling to the course to which they are currently committed, especially at turning points.”

Research

Apollo explores how professional sports have become a large, underlevered asset class with a financing gap around $2.5 trillion. They argue that structured and private credit can help owners unlock liquidity while preserving control and long term franchise value.

Man Group - Golden Fears (29 pages)

Man Group examines whether gold still works as a defensive asset in portfolios rather than a guaranteed safe haven. They conclude that gold can modestly hedge inflation and some market stress but offers limited overall diversification benefits today.

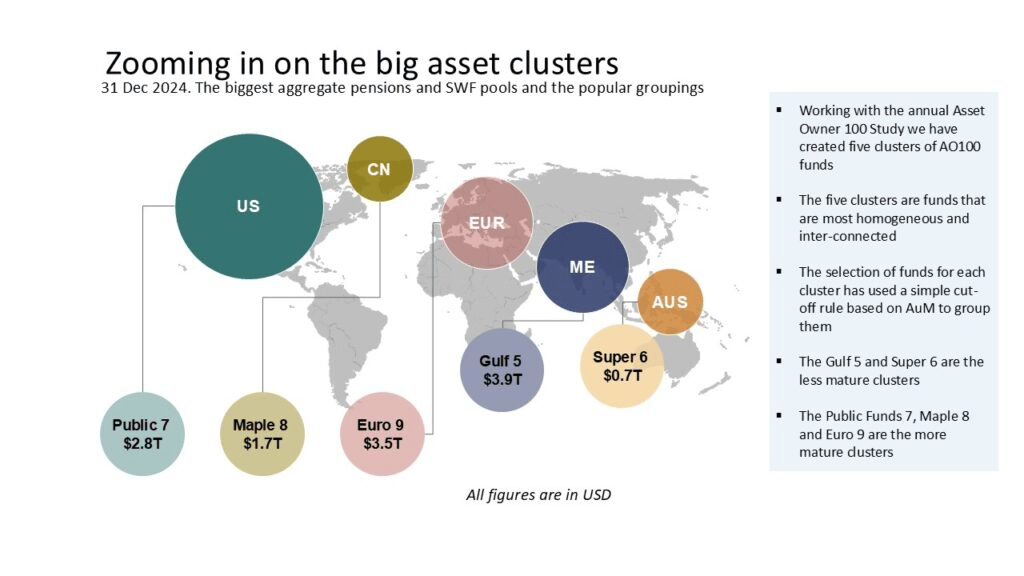

Thinking Ahead Institute - The Asset Owner 100 | The most influential capital on the planet (16 pages)

The study reveals the world’s 100 largest asset owners are now responsible for $29.3 trillion as of the end of 2024; experiencing an increase in assets of 11.3% compared to the previous year.

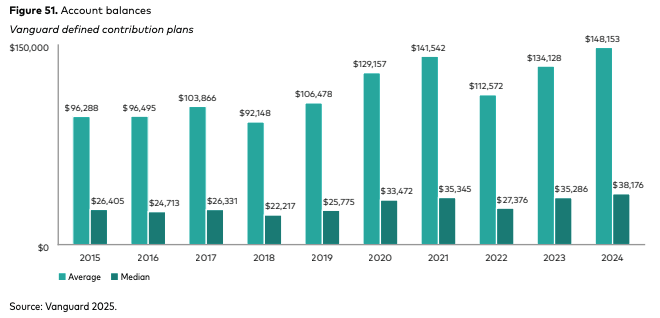

Vanguard - How America Saves 2025 (112 pages)

Vanguard analyzes how Americans are saving for retirement in employer plans and finds participation and savings behaviors largely resilient despite economic uncertainty.

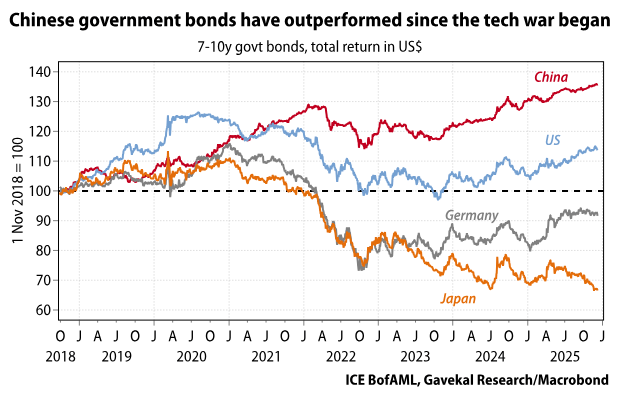

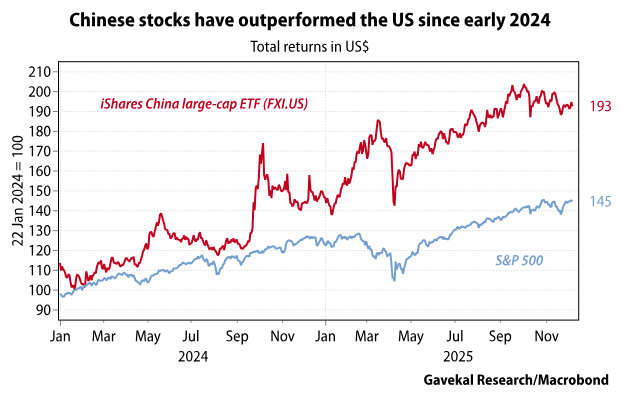

Gavekal Research contrasts recent US equity strength with claims that China has become uninvestible. They argue China has absorbed weak markets to rebuild domestic supply chains while the United States enjoyed asset gains, leaving investors now facing tougher policy and allocation choices.

Bonus Content

Andrej Karpathy shared 6 notable and mildly surprising "paradigm changes" related to LLMs. Link

Casey Handmer, founder of Terraform Industries, shared some energy predictions. Link

As nontraded funds go public, the market is deciding they aren’t worth as much as managers say. Link

Seth Klarman explains what made Warren Buffett an American role model. Link

Sticking with a dividend growth strategy can provide useful diversification while creating an opportunity to compound returns over the long term. Link

Tom Whitwell’s annual post: 52 things I learned in 2025. Link

Stanford’s Nick Bloom gives an update on work from home and AI trends. Link

Market Outlooks

Our website features over 50 outlooks for 2026. Check them out here.

Podcasts

Logan Mohtashami breaks down first-time homebuyers, housing supply constraints, and what it takes to fix today’s affordability crunch. |

Luke Gromen explains cash’s vulnerabilities, gold’s portfolio role, and macro forces reshaping currency and bonds. |

Henry Ellenbogen discusses man versus machine in investing, balancing human judgment with data driven tools, building durable growth portfolios. |

What Else Is Happening

Did you miss last week’s email?

ICYMI: We shared 50 facts from 2H25.

32 guests from The Meb Faber Show shared 60+ book recommendations.

Deal of the Week

Daffy was built to help people be more generous, more often. Whether you’re looking to be more intentional with your giving, simply consolidate all your donation receipts into one place, or maximize the many tax benefits of giving through a donor-advised fund, Daffy may be for you.

Get an extra $25 for charity when you join Daffy today.